Exercise

Exercise

Tap all the highlighted words in the transcript below to see their definition. ⇩Of course, the answer to this question will be very different depending on what kind of investor and entrepreneur we are talking about. Let’s focus specifically on new entrepreneurs who are looking for early seed stage investors to boost their growth. Let’s imagine one entrepreneur who has put their idea and project in place and now they need someone to trust them and invest in them.

For sure this entrepreneur will speak to potential investors, send emails, participate in events to find contacts and have an investors deck. But in the end, most investors are looking for the same things that will not necessarily secure their investment but will at least generate their interest.

There are two initial important statements to get started.

1. There is way more money to be invested around than interesting projects to locate the investment. As an early entrepreneur you might think it’s very hard to get the money. But it’s way harder for investors to find the right place to put it. Money is not the problem, but rather the allocation. So think about what problem you are fixing for each investor first.

2. Ideas themselves are overestimated. Most early-stage visions and products will change as they face reality and clients. It does not matter how good your idea is since it has little value. It’s the ability to execute it that makes an entrepreneur successful.

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.”

What are the Investors Looking for?

1. What problem are you fixing? This is a basic but crucial element. Any entrepreneur trying to raise a new startup needs to clearly and specifically answer what consumer or company problem they are fixing. It can’t be abstract, nor doubtful or questionable. It needs to be certain.

Examples:

- Consumers do not have one location to find all the information and websites on the internet. Solution: Google.

- Car pollution will become unsustainable and fossil oils will run out soon. Solution: Tesla.

2. Is there a market for it? Once you know what problem you are trying to solve, you need to understand if other people are already solving it one way or another, if you are able to do it better than anyone else and why, and, most importantly, if the consumers will be willing to pay for it.

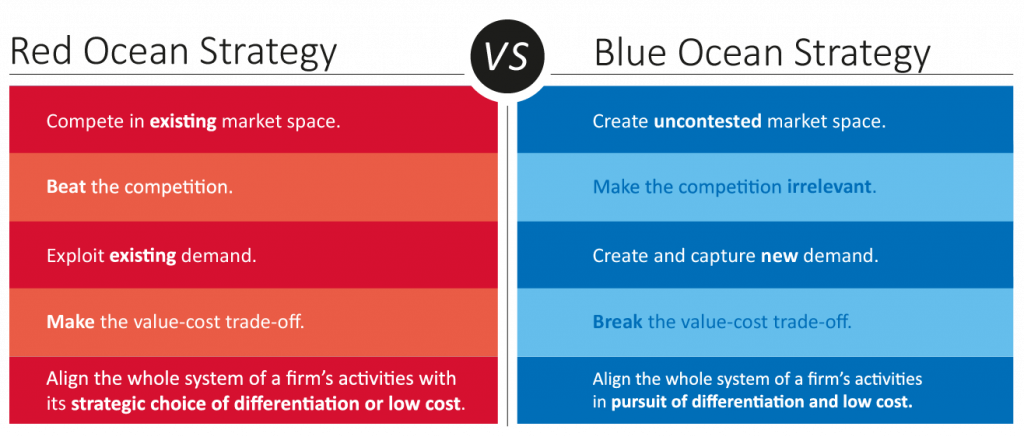

The Blue ocean strategy is about finding markets where there is a clear opportunity because the need and lack of strong competition are not blocking your way in. (vs. Red Ocean markets, where despite the obvious market, there is plenty of competition ready to fight and beat you).

3. How many times have you tried and failed before? Statistically, it’s very difficult to find one entrepreneur who didn’t fail and got everything correct in their first venture. The more experience an entrepreneur has in failing, the higher the chances that it will work next time. Also, an entrepreneur who failed before has proved endurance and resilience.

Examples:

- Evan Williams: Before founding Twitter, he developed a podcasting platform called Odeo that didn’t take off, in part because at the same time, Apple launched iTunes.

- James Dyson: Dyson wasn’t always a well-known name associated with vacuum cleaners. In fact, it took Sir James Dyson 15 years and all of his savings to develop a bagless prototype that worked. He developed 5,126 prototypes that failed first.

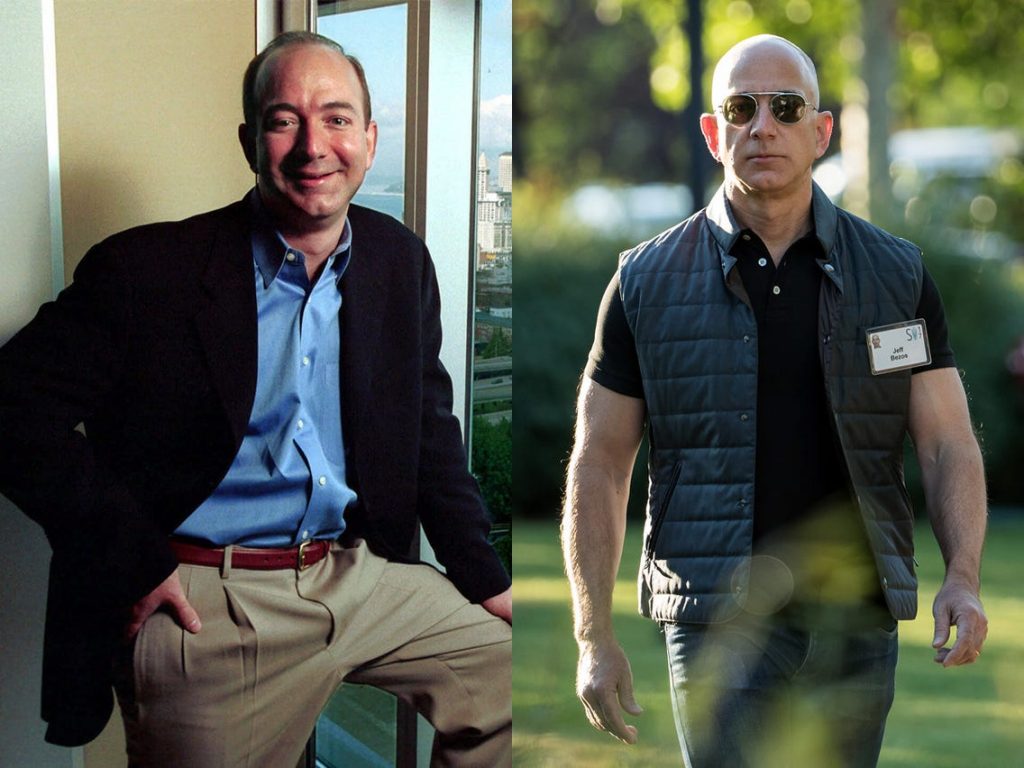

- Jeff Bezos: Amazon is one of the biggest success stories of the online era. But before Amazon became a household name, the company’s CEO had several failed ideas. One of the most notable was an online auction site, which evolved into zShops, a brand that ultimately failed.

“I knew that if I failed I wouldn’t regret that, but I knew the one thing I might regret is not trying.”

4. What is your partner like? Statistically, cofounders have higher chances in succeeding than founders alone. They can’t be friends but business partners with different and complementary skills. They will help each other by reducing risks of exposure, ensuring that decisions are more considered, and, if the founder fails, he is not alone.

5. Show me the numbers. Investors are going to be excited and inspired by your energy and vision, but they will require you to have proven your idea and business model behind it. It needs reality to get started. A reality that generates early results. They want you to have a clear idea about how you are going to make money from this business (business model), and how you are going to make it scale (grow). Do not expect any investor to be interested in your project from a Power Point presentation alone. (unless you are a serial entrepreneur and investors already have full trust in you).

6. Full dedication: It’s quite common to see potential entrepreneurs looking for investors when they have not yet invested their entire time or own money. Of course you need to make a living and this is understandable, but if you don’t trust yourself enough to put all your time, dedication and part of your money, you can’t expect an external investor who does not know you, to do it for you.

By covering all these points, you won’t have a secured investor interested to put their money in your idea at all. It will just be the first step for you on the journey and may create a possibility.

Grammar – Future: “WILL”

See more

- We form the Simple Future with WILL plus the infinitive form of the verb.

For example:

– It will rain tomorrow. (Prediction)

– I will be with you the whole day. (Promises)

– I will help you with that. (Offer)

– I will call you right back. (Spontaneous decission).

The structure in the affirmative form is:

Subject + will + verb + objectWe can also use the contracted form ‘LL.

For example:

– She’ll be home by 10 o’clock.

– They’ll give us a hand for the move.

Related Course Units

Go back to unit 3 to complete all 5 microlessons.

It is nice to read interesting things and to be learning English…

This articule is so difficult for me.

Keep up the effort, Mara.

Thanks!

This article is interesting… 🤔

Congratulations. Very interesting!