Exercise

Exercise

Tap all the

highlighted words in the text below to see their definition.

⇩Most business plans (aka, BP.) feature a lot of English terms that are important to understand. Each business plan is different, but they have some common elements. We are talking about a written document in which we describe in a certain amount of detail, how the business is going to achieve its goals. It explains the strategy behind our objectives including operations, marketing, finance, sales and so on.

This section acts as a summary. It outlines the mission statement, the key challenges and opportunities and most important milestones to achieve. It helps to put things into perspective. Also explaining the nature of your business will be important (e.g: Is it a B2B or a B2C business?) It should be no longer than 400 words.

- Market analysis and benchmark

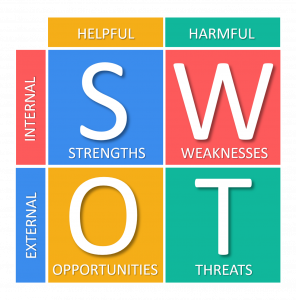

It should explain the size, the evolution and the conditions of your market or industry. It can also include a good analysis of your main competitors. It’s very frequent to use a SWOT analysis to produce this part of the business plan.

This section needs to explain how the business works at operational level. Teams, departments, contracts, synergies, costs. What are the important elements it takes for your business to run? Then, focus on how to improve it and what you need to do so.

- Marketing and sales strategy

How are you going to market and sell your product or services? What’s going to be your market positioning? How will you price it? In general terms, you will explain how you will acquire clients, how you will retain them and how you will monetize them.

First who, then what. If you want this plan to be successful, you will need the right team and organization. What is your situation today? What skills do the team need to develop? How is your organization structured? Who are the top leaders that you will need to achieve the plan?

Explain how you will achieve this plan financially. The goal of this section is to highlight the financial needs or risks during the plan execution. You should include the balance sheet and other financial information which is crucial to understand your business. Revenue, margin, Marketing investment, OPEX, CAPEX, EBITDA and cash balance.

Exercise

Exercise

I agree with Nic.

What’s up with ROI, TIR, EVA and EBIDTA?

Excelente! But de voice is horrible